CRM Systems for Banks: Improve Financial Services

In today’s competitive financial landscape, banks are constantly seeking ways to enhance their services and customer relationships. CRM systems for banks have emerged as a game-changing solution, revolutionizing how financial institutions interact with their clients.

At Drop Cowboy, we’ve seen firsthand how these powerful tools can transform banking operations, from streamlining processes to delivering personalized experiences. This blog post will explore the benefits of CRM systems in banking and provide insights on successful implementation strategies.

What Are CRM Systems in Banking?

The Core of Banking CRM

Customer Relationship Management (CRM) systems have become essential tools for banks to maintain competitiveness in today’s financial landscape. These platforms centralize customer data, automate processes, and provide actionable insights, surpassing traditional banking software capabilities.

A banking CRM serves as a comprehensive solution that helps financial institutions manage and analyze customer interactions throughout the entire customer lifecycle. It creates a 360-degree view of each customer’s financial journey, not just storing contact information.

For instance, when a customer enters a branch, a teller using a CRM system can immediately access their complete profile (including recent transactions, product preferences, and life events that might influence their financial needs). This level of insight enables more personalized service and targeted product recommendations.

Key Features That Set Banking CRMs Apart

Banking CRMs include features specifically designed for the financial sector. A standout feature allows customer segmentation based on various criteria such as income, investment portfolio, or credit score. This segmentation enables banks to tailor their marketing efforts and product offerings more effectively.

Regulatory compliance management stands out as another critical feature. With ever-changing financial regulations, CRMs help banks maintain compliance by automating reporting processes and maintaining detailed audit trails of customer interactions.

The Shift from Traditional Banking Software

CRMs prioritize relationship building, unlike traditional banking software that primarily focuses on transaction processing. While legacy systems excel at handling deposits and withdrawals, they often lack in providing a holistic view of the customer.

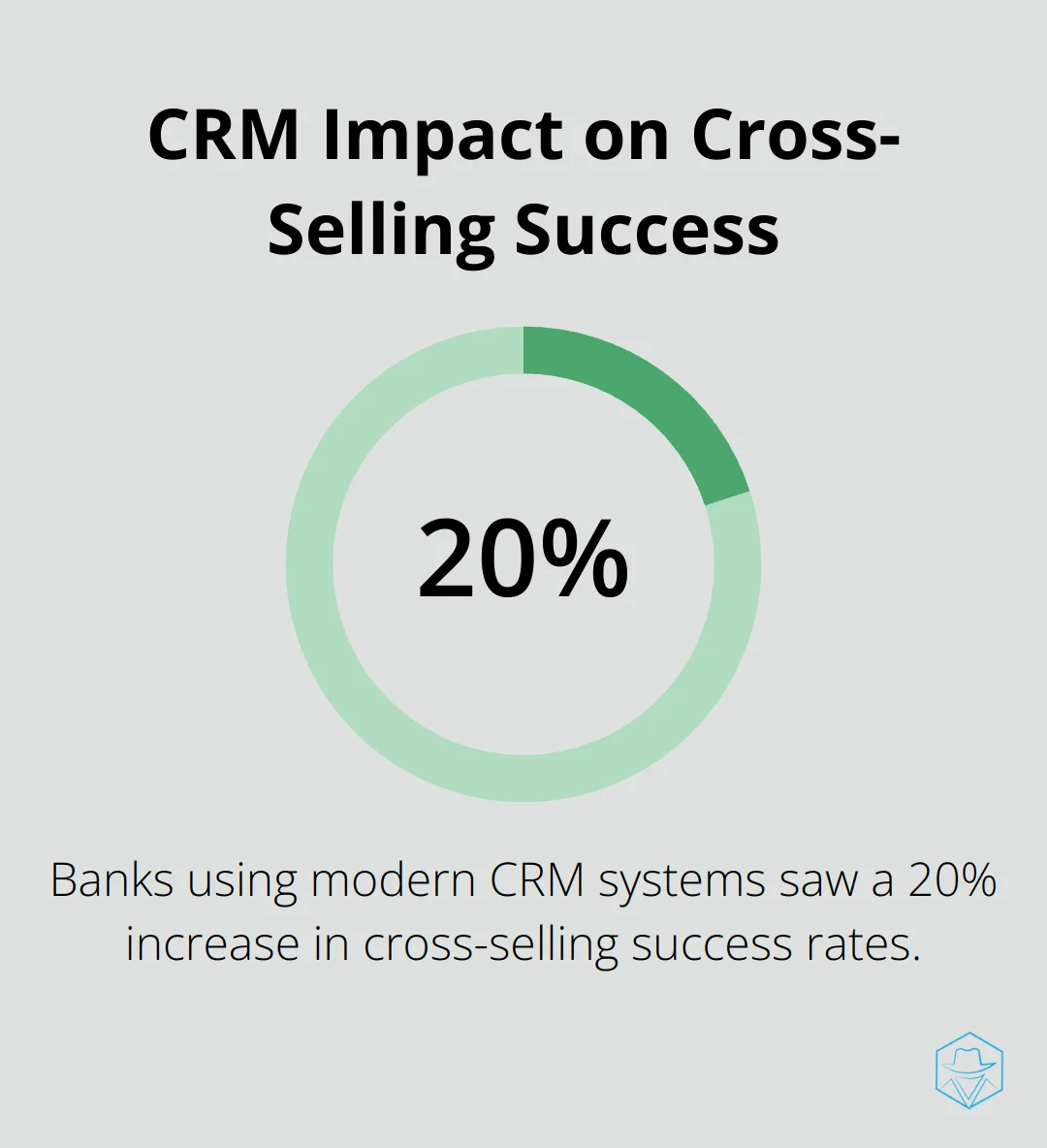

A Forrester Research study found that banks using modern CRM systems experienced a 20% increase in cross-selling success rates compared to those relying on traditional software. This significant difference highlights the power of CRM in driving revenue growth through improved customer understanding.

Integration with Existing Infrastructure

Banks that integrate CRM systems with their existing infrastructure can achieve remarkable improvements in customer satisfaction and operational efficiency. The key lies in selecting a CRM that aligns with the bank’s specific needs and seamlessly integrates with the current tech stack.

As we move forward, it’s important to understand how these CRM systems can benefit banks in more concrete ways. Let’s explore the specific advantages that CRM systems bring to financial institutions.

How CRM Systems Benefit Banks

Driving Revenue Through Personalization

CRM systems have transformed the banking industry, offering advantages that extend beyond basic customer data management. These systems have become essential tools for financial institutions aiming to maintain competitiveness in an increasingly digital landscape.

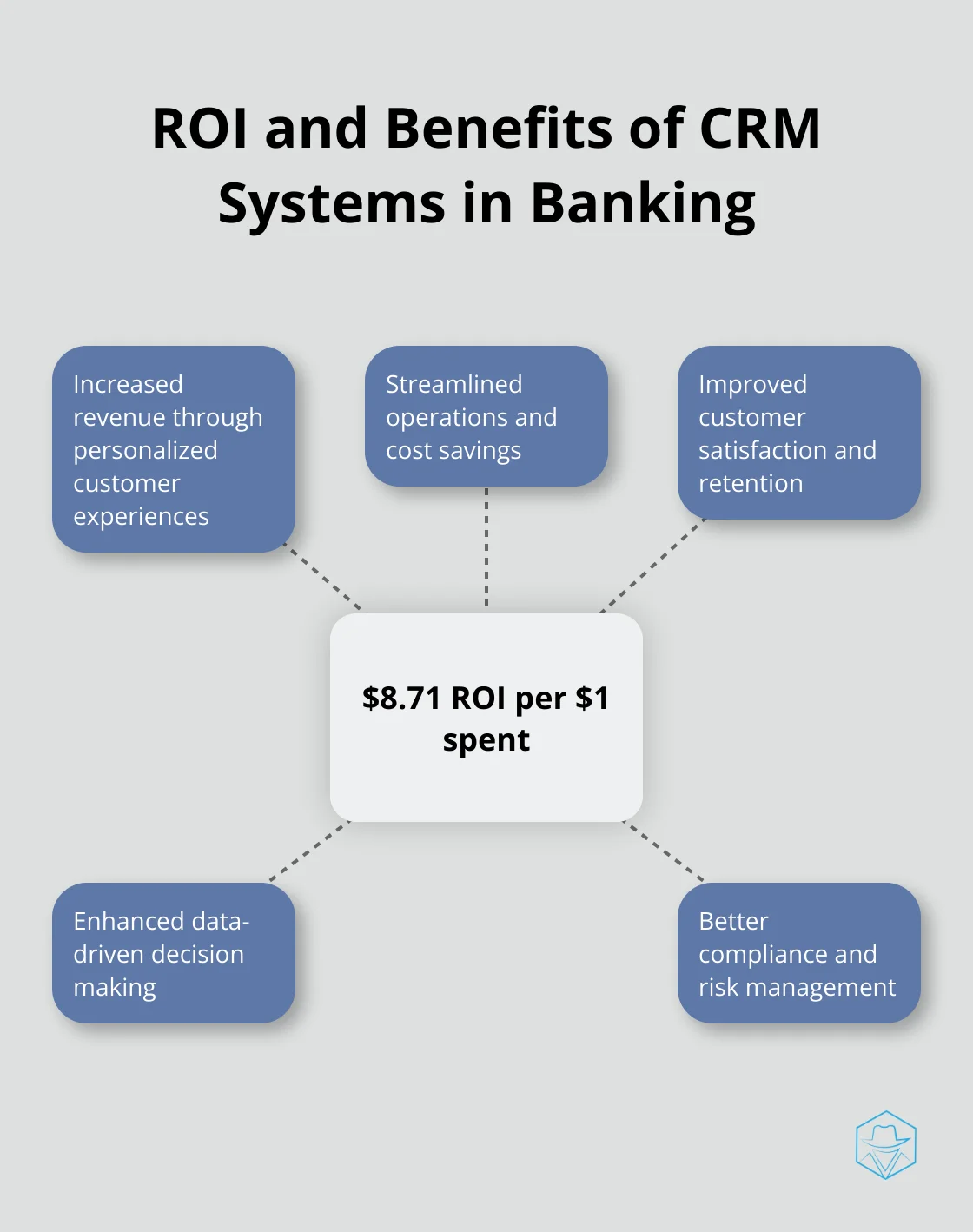

One of the most significant benefits of CRM systems in banking is their ability to deliver highly personalized experiences to customers. By analyzing customer data, banks can tailor their products and services to meet individual needs. A study by Boston Consulting Group found that personalization in banking can increase revenue by up to 10% annually.

Enhancing Operational Efficiency

CRM systems streamline banking operations by automating routine tasks and centralizing customer information. This efficiency translates directly to cost savings and improved service quality. A report by Nucleus Research indicates that CRM systems can yield an average return on investment of $8.71 for every dollar spent.

Banks using CRM systems have reported significant time savings in customer onboarding processes. For example, a major European bank reduced its account opening time from 45 minutes to just 5 minutes after implementing a comprehensive CRM solution (a 89% reduction). This efficiency not only improves customer satisfaction but also allows bank staff to focus on more value-added activities.

Leveraging Data for Strategic Decision-Making

CRM systems provide banks with powerful analytics tools that convert raw data into actionable insights. These insights can inform everything from product development to risk assessment. A survey by Gartner revealed that 70% of banking executives believe customer analytics will be critical for their competitive advantage in the coming years.

With the right CRM system, banks can predict customer needs, identify cross-selling opportunities, and even detect potential fraud. A large U.S. bank used CRM analytics to identify high-value customers at risk of churning and implemented targeted retention strategies, resulting in a 25% reduction in attrition rates.

Improving Customer Relationship Management

CRM systems enable banks to manage customer relationships more effectively. They provide a 360-degree view of each customer, including their transaction history, preferences, and interactions with the bank. This comprehensive view allows bank employees to provide more personalized and efficient service.

For instance, when a customer calls with an inquiry, a bank representative can quickly access their complete profile and history, leading to faster resolution times and increased customer satisfaction. Some banks have reported a 15% increase in customer satisfaction scores after implementing CRM systems.

Facilitating Compliance and Risk Management

In the heavily regulated banking industry, CRM systems play a vital role in ensuring compliance and managing risk. These systems can automate many compliance-related tasks, such as generating reports for regulatory bodies and maintaining audit trails of customer interactions.

CRM systems also help banks identify and mitigate risks more effectively. They can flag unusual account activity, potentially indicating fraud, and help banks comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

The benefits of CRM systems in banking are clear and multifaceted. However, to reap these benefits, banks must choose the right CRM solution and implement it effectively across their organization. The next section will explore the key considerations and best practices for implementing CRM systems in banks.

Implementing CRM in Banks: A Practical Guide

Selecting the Right CRM Solution

Banks must choose a CRM solution that offers industry-specific features such as compliance management tools and integration capabilities with core banking systems. A Forrester Research study found that 60% of financial institutions consider industry-specific functionality as the most important factor when selecting a CRM system. This emphasis on tailored solutions has led to the rise of specialized banking CRM providers.

When evaluating CRM options, banks should consider factors such as scalability, customization options, and mobile accessibility. For example, a large multinational bank might require a highly scalable solution with multi-language support, while a local credit union might prioritize ease of use and cost-effectiveness.

Integrating with Existing Systems

Banks must integrate their CRM seamlessly with existing banking systems to maximize benefits. This integration allows for real-time data flow between systems, providing a comprehensive view of customer interactions across all touchpoints.

A case study from a mid-sized regional bank in the U.S. showed that integrating their new CRM with their core banking system resulted in a 30% reduction in data entry errors and a 25% increase in customer service efficiency.

To ensure successful integration, banks should:

- Conduct a thorough audit of existing systems and data structures

- Develop a clear integration strategy with defined data flows

- Use API-led connectivity for flexible and scalable integration

- Implement rigorous testing procedures to ensure data accuracy and system performance

Overcoming Implementation Challenges

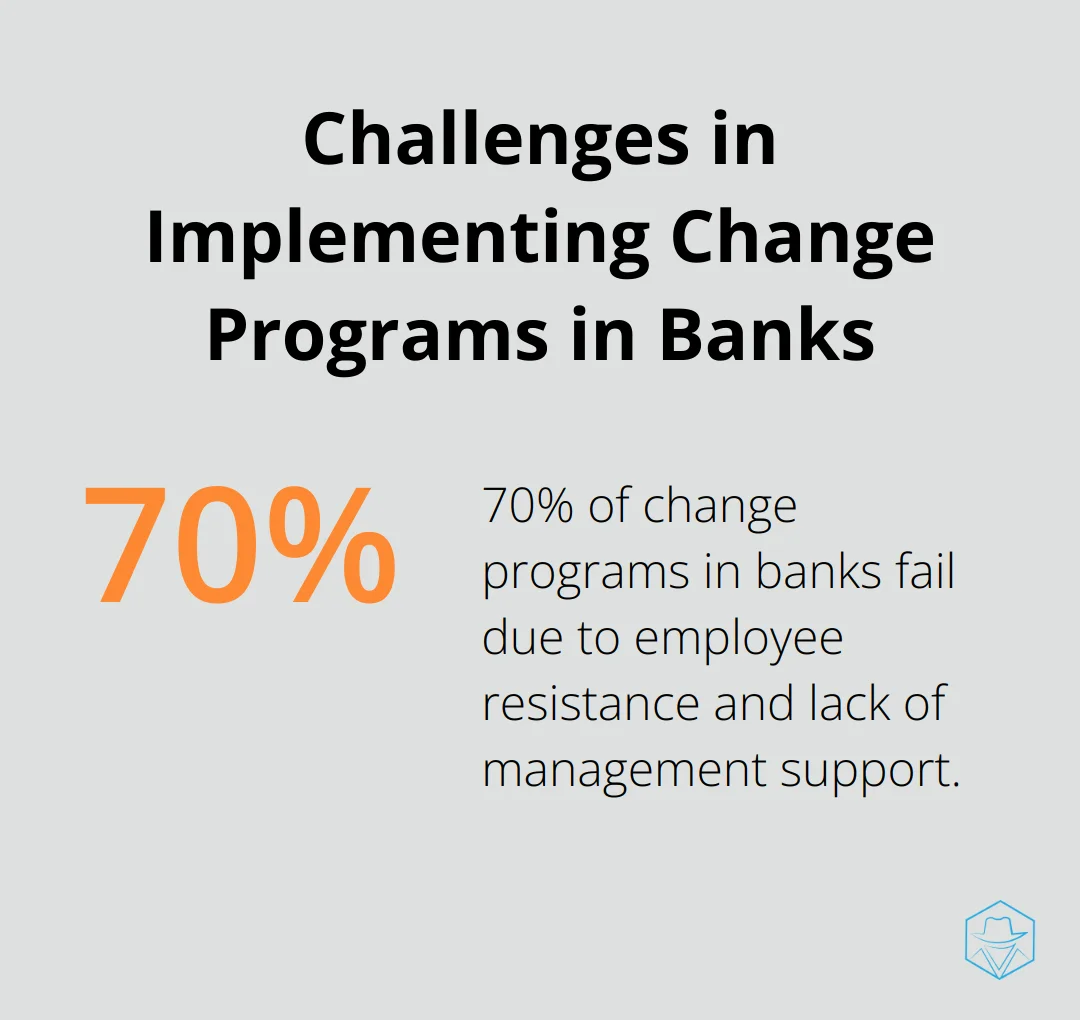

One of the biggest challenges in CRM implementation is resistance to change from staff. A survey by McKinsey found that 70% of change programs in banks fail due to employee resistance and lack of management support.

To overcome this, banks should:

- Involve employees in the selection and implementation process

- Provide comprehensive training programs tailored to different user groups

- Communicate the benefits of the new system clearly and consistently

- Offer ongoing support and create a feedback loop for continuous improvement

A large European bank successfully implemented a new CRM by creating a network of “CRM champions” across departments. These champions received advanced training and acted as on-ground support for their colleagues, significantly improving adoption rates.

Ensuring Data Security and Compliance

Data security is paramount in banking CRM implementation. Banks must ensure that their CRM systems comply with regulations such as GDPR, PSD2, and local data protection laws.

Key considerations include:

- Implementing robust encryption for data at rest and in transit

- Setting up role-based access controls to protect sensitive information

- Establishing clear data retention and deletion policies

- Conducting regular security audits and penetration testing

An IBM study found that the average cost of a data breach in the financial sector is $5.85 million, underlining the importance of robust security measures.

Implementing a CRM system in a bank is a significant undertaking (but when done correctly, it can transform customer relationships and drive business growth). Banks can set themselves up for CRM success by focusing on selecting the right solution, ensuring seamless integration, overcoming resistance to change, and prioritizing data security.

Final Thoughts

CRM systems for banks have revolutionized the financial landscape. These platforms enhance customer relationships, drive revenue through personalization, and streamline operations while ensuring regulatory compliance. The future of banking CRM systems will likely include more AI and machine learning capabilities, enabling sophisticated predictive analytics and personalized experiences.

Banks that effectively use CRM systems will attract and retain customers, optimize operations, and stay ahead of regulatory requirements. The ability to deliver personalized, efficient, and compliant services will differentiate successful financial institutions in an increasingly competitive sector. Customer expectations continue to rise, making the implementation of robust CRM systems a necessity for banks.

Drop Cowboy complements CRM systems with innovative tools for personalized outreach. Our platform provides ringless voicemail and SMS capabilities (enhancing customer engagement strategies). Banks can drive business growth in the digital age by integrating advanced communication solutions with CRM systems.

blog-dropcowboy-com

Related posts

August 22, 2025

The Rise of AI in Messaging How It’s Changing the Game

Discover how AI messaging is transforming communication, boosting efficiency, and revolutionizing customer experiences across industries.

June 16, 2025

How to Leverage B2B Telemarketing to Skyrocket Your Business Growth

Are you ready to take your B2B sales to the next level? B2B telemarketing strategies are the secret weapon you require to build strong client relationships, generate high-quality leads, and boost your revenue. Statista.com reports that ad spending in the global telemarketing market is expected to grow at a CAGR of 0.45% from 2025 to 2030. B2B […]

May 15, 2025

Using GoHighLevel to Scale Your Sales and Marketing Workflows

Boost your sales and marketing workflows with GoHighLevel. Explore how to streamline your strategies and achieve growth effectively.

March 20, 2025

Zoho Marketing Automation: Features and Advantages

Explore Zoho Marketing Automation features and benefits to streamline your campaigns and boost engagement effectively.

March 22, 2025

Top iPaaS Tools for Seamless Data Integration

Explore top iPaaS tools for seamless data integration. Discover efficient solutions for enhancing connectivity and streamlining your business processes.

July 1, 2025

Contact Center Dialer: Improve Customer Interactions

Boost customer interactions using a contact center dialer. Learn practical tips and trends to enhance efficiency and customer satisfaction instantly.