How to Streamline Lending with LoanPro Software

At Drop Cowboy, we’re always on the lookout for tools that can revolutionize business operations. LoanPro software is one such game-changer in the lending industry.

This powerful platform streamlines lending processes, enhances customer experiences, and boosts overall efficiency. In this post, we’ll explore how LoanPro can transform your lending business and drive growth.

What Makes LoanPro Software Stand Out?

LoanPro software revolutionizes lending operations with its powerful features. The platform’s automated loan origination process reduces manual work and accelerates approvals throughout the lending lifecycle (from application to funding).

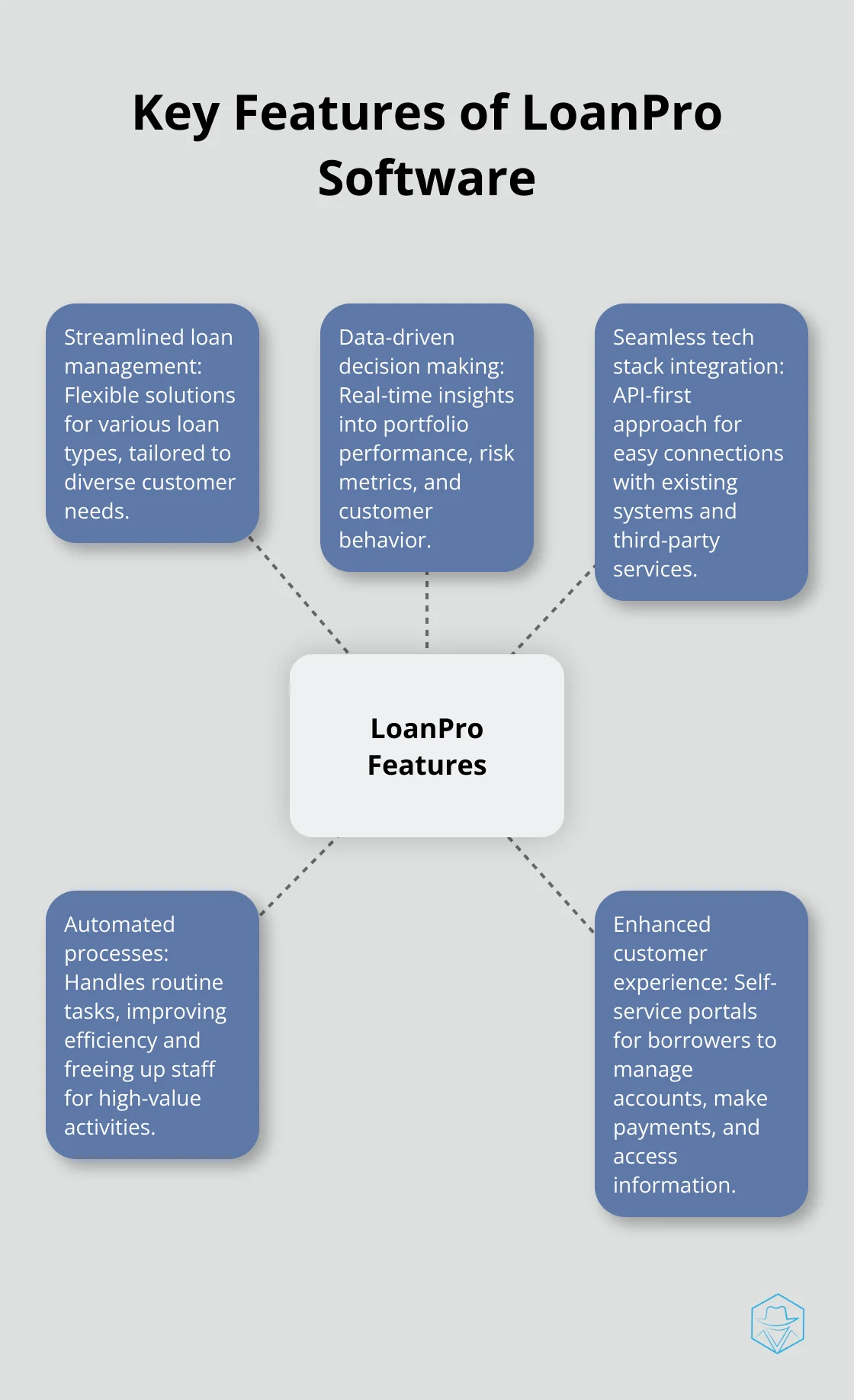

Streamlined Loan Management

LoanPro offers flexible loan servicing solutions that adapt to various loan types (installment loans, lines of credit, and complex custom structures). This flexibility allows lenders to tailor offerings to diverse customer needs without managing multiple systems.

Data-Driven Decision Making

The comprehensive reporting and analytics tools in LoanPro provide real-time insights into portfolio performance, risk metrics, and customer behavior. These data-driven insights enable lenders to make quick, informed decisions, adjust strategies, and identify growth opportunities.

Seamless Tech Stack Integration

LoanPro’s API-first approach facilitates easy connections with existing systems and third-party services. This interoperability creates a cohesive tech ecosystem without disrupting current operations.

Automated Processes

LoanPro automates key lending processes, which significantly improves efficiency. The software handles routine tasks, freeing up staff to focus on high-value activities and customer relationships.

Enhanced Customer Experience

The platform includes self-service portals that empower borrowers to manage their accounts, make payments, and access important information. This feature improves customer satisfaction and reduces the workload on customer service teams.

LoanPro’s feature set addresses the pain points of modern lending. It empowers lenders to operate efficiently and scale their businesses effectively. As we move forward, let’s explore how these features translate into tangible benefits for lending operations.

How LoanPro Streamlines Lending Operations

LoanPro transforms lending operations, making them faster, more efficient, and customer-friendly. This software revolutionizes lending processes in several key areas.

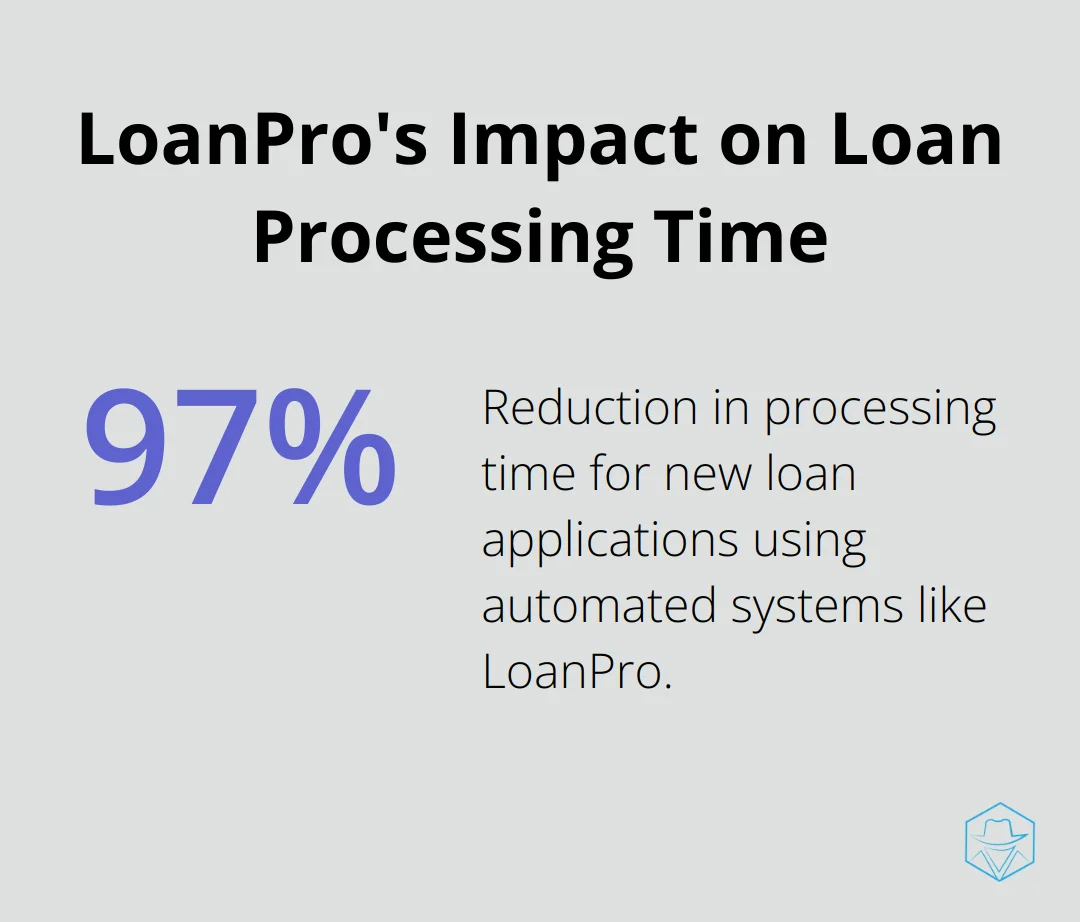

Accelerated Loan Applications and Approvals

LoanPro’s automated loan origination process cuts down application processing times dramatically. Industry data shows that lenders using similar automated systems experience a 97% reduction in processing time for new applications. Loans that once took days to approve can now be processed in hours or even minutes.

The software automates KYC checks and integrates with underwriting tools to speed up the process further. Lenders can set up custom workflows that automatically flag high-risk applications for manual review while fast-tracking low-risk ones. This smart allocation of resources not only accelerates approvals but also enhances risk management.

Enhanced Customer Experience through Self-Service Portals

LoanPro’s self-service portals transform the customer experience. Borrowers can access their account information, make payments, and even apply for new loans without contacting customer service. This 24/7 accessibility improves customer satisfaction and reduces the workload on staff.

One client reported a 40% decrease in customer service calls after implementing these self-service features. This allowed their team to focus on more complex customer needs and value-added services.

Optimized Loan Servicing and Collections

LoanPro’s automation capabilities extend to loan servicing and collections (areas that traditionally require significant manual effort). The software automatically generates payment reminders, late notices, and even initiates collection processes based on predefined rules.

LoanPro identifies accounts at risk of default and triggers proactive outreach, potentially preventing delinquencies before they occur. Some lenders using this feature have reported a 50% reduction in default rates within the first year of implementation.

The platform handles complex loan structures and modifications, streamlining servicing operations. It automates processes such as adjusting payment schedules, processing deferments, and managing hardship programs, which reduces errors and improves efficiency.

Improved Compliance and Risk Management

LoanPro’s comprehensive approach to lending operations addresses key compliance and risk management challenges. The software maintains detailed audit trails, making it easier to track and resolve issues as they arise within loan management processes.

The platform’s Compliance Safeguard feature helps lenders align with ever-changing regulations, reducing the risk of regulatory penalties. This proactive approach to compliance can save lenders significant time and resources.

LoanPro’s powerful features address the evolving needs of the lending industry. As we explore the next section, we’ll examine how these streamlined operations translate into tangible returns on investment for lenders.

How LoanPro Software Boosts Your Bottom Line

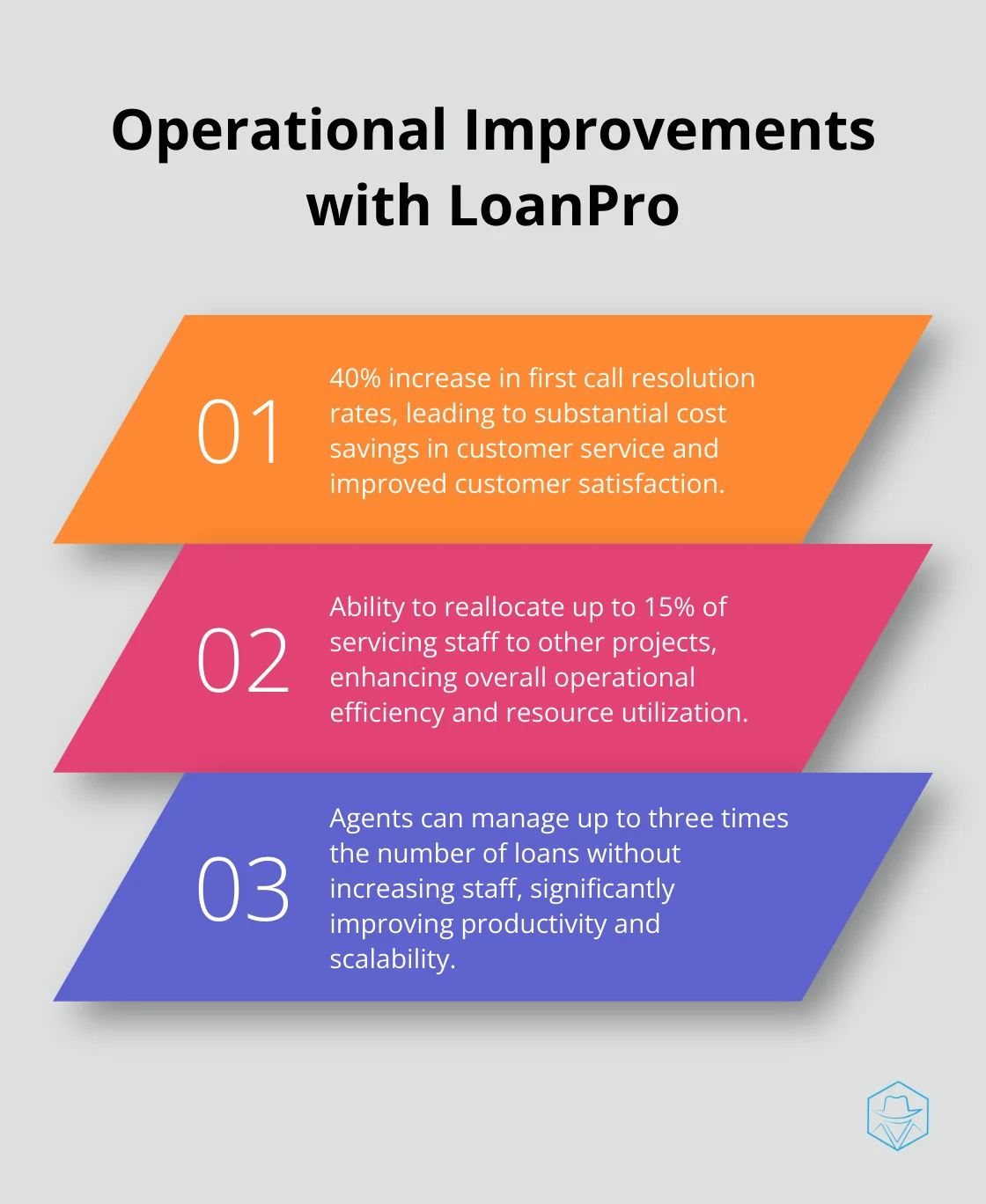

Slash Operational Costs

LoanPro’s automation capabilities reduce operational expenses significantly. A top B2B lender reported a 40% increase in first call resolution rates after adopting LoanPro, which led to substantial cost savings in customer service. LoanPro users have reallocated up to 15% of their servicing staff to other projects, enhancing overall operational efficiency.

The platform’s automated processes handle routine tasks, allowing staff to focus on high-value activities. This shift improves productivity and reduces the need for additional headcount as the business grows. LoanPro’s automation features enable agents to manage up to three times the number of loans without increasing staff.

Scale Your Lending Business

LoanPro’s flexible architecture allows lenders to launch new loan products rapidly. Users have reported launching differentiated credit products in weeks instead of months, which significantly improves time-to-market. This agility enables lenders to quickly capitalize on market opportunities and stay ahead of competitors.

The platform handles various loan types (from installment loans to lines of credit), which means lenders can easily diversify their portfolio without investing in multiple systems. This versatility proves crucial for scaling operations and entering new markets efficiently.

Make Data-Driven Decisions

LoanPro’s comprehensive reporting and analytics tools provide real-time insights into portfolio performance. These data-driven insights enable lenders to make informed decisions quickly, adjust strategies on the fly, and identify growth opportunities.

LoanPro’s pre-built reports allow for effective monitoring of portfolio health, including delinquency rates and charge-off history. This level of visibility helps lenders proactively manage risk and optimize their lending strategies for maximum profitability.

Boost Customer Retention

LoanPro’s self-service portals and automated communication features enhance the customer experience significantly. Borrowers can easily manage their accounts, make payments, and access important information without contacting customer service. This convenience leads to higher customer satisfaction and improved retention rates.

Moreover, LoanPro’s ability to identify accounts at risk of default allows lenders to implement proactive measures. Some lenders using this feature have seen a 50% reduction in default rates within the first year, which directly impacts the bottom line.

Final Thoughts

LoanPro software revolutionizes the lending industry with its comprehensive solution to streamline operations and drive growth. The platform automates loan origination, servicing, and collections, which allows lenders to reduce operational costs while increasing efficiency. LoanPro’s flexible architecture enables rapid product launches and easy portfolio diversification, which positions lenders to capitalize on market opportunities swiftly.

Real-time analytics and reporting tools provided by LoanPro software give lenders the insights they need to make data-driven decisions and manage risk effectively. This level of visibility and control proves essential in today’s fast-paced lending environment (where market conditions can change rapidly). LoanPro enhances the customer experience through self-service portals and proactive account management features, which can become a key differentiator for lenders looking to build long-term relationships.

We at Drop Cowboy understand the power of innovative technology in transforming business operations. Our communication platform enhances marketing efforts through advanced ringless voicemail and SMS capabilities. LoanPro software offers a compelling solution for lenders who want to modernize their operations, reduce costs, and improve customer satisfaction.

blog-dropcowboy-com

Related posts

July 20, 2025

How iPaaS Benefits Modern Enterprises

Explore the benefits of iPaaS for enterprises, from enhancing efficiency to streamlining processes and driving growth in the digital age.

March 26, 2025

Pipedrive vs HubSpot: Which CRM is Right for You?

Compare Pipedrive vs HubSpot to find your ideal CRM. Explore features, pricing, and user-friendliness to make an informed choice for your business.

March 4, 2025

Understanding Text Marketing Laws and Regulations

Navigate text marketing laws effectively. Learn essential guidelines, ensure compliance, and protect your business while communicating through texts.

July 20, 2025

ClickSend Reviews: What Do Customers Really Think?

Explore ClickSend reviews and see what customers are saying. Gain insights into user experiences and discover how this service meets business needs.

July 20, 2025

How Much Does TextMagic Cost?

Discover TextMagic cost breakdown, features, and plans. Save more by comparing options and find the perfect fit for your messaging needs.

May 27, 2025

Close CRM: Is It the Best Option for Your Sales Team?

Explore Close CRM reviews and see if it’s the best fit for your sales team with insights, pros, cons, and practical advice for seamless sales management.