What Is Real Estate Wholesale and How Does It Work?

Real estate wholesaling is a unique investment strategy that’s gaining traction in the property market. At Drop Cowboy, we’ve seen a growing interest in this approach among our clients.

What is real estate wholesaling? It’s a method where investors find undervalued properties, secure them under contract, and then sell those contracts to other buyers for a profit.

This blog post will break down the process, explore its pros and cons, and help you decide if it’s the right path for your investment goals.

What Is Real Estate Wholesaling?

Definition and Core Concept

Real estate wholesaling is a strategy where investors act as intermediaries between motivated sellers and potential buyers. Wholesalers find undervalued properties, secure them under contract, and sell those contracts to other investors for a profit. This approach allows for quick transactions with minimal capital investment.

Key Players in the Wholesaling Process

Three main parties participate in wholesaling:

- The wholesaler: Identifies distressed properties and negotiates with owners

- The property owner: Often motivated to sell quickly (e.g., facing foreclosure or inherited properties)

- The end buyer: Typically an investor seeking below-market-value properties for flipping or renting

Wholesaling vs. Traditional Real Estate Investing

Wholesaling differs significantly from traditional real estate investing. Wholesalers don’t purchase properties outright; instead, they secure the rights to buy a property through a contract and assign those rights to another buyer for a fee. This approach requires less capital and allows for faster transactions compared to direct property purchases.

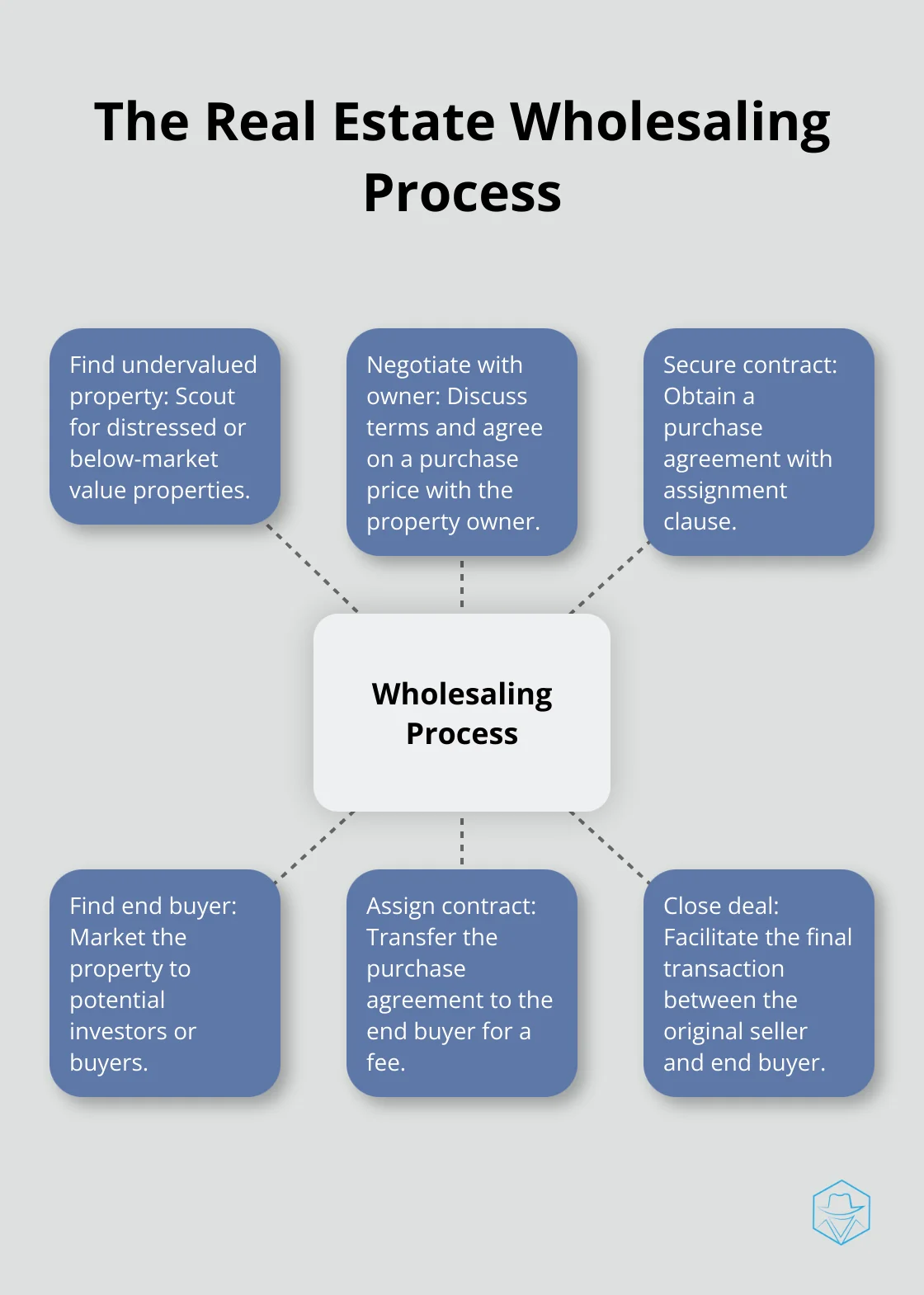

The Wholesaling Process in Action

A typical wholesaling deal might unfold as follows:

- A wholesaler locates a distressed property worth $200,000 (requiring $50,000 in repairs)

- The wholesaler negotiates with the owner to purchase it for $120,000

- An investor agrees to buy the property for $130,000

- The wholesaler assigns the contract to the investor, earning a $10,000 profit without owning the property

Legal and Ethical Considerations

Wholesaling operates in a legal gray area in some states. For example, Arizona recently enacted laws requiring specific disclosures for wholesalers. We always recommend consulting with a real estate attorney to ensure compliance with local regulations before engaging in wholesaling activities.

Essential Skills for Wholesaling Success

Successful wholesalers excel at:

- Networking: Building relationships with motivated sellers and cash buyers

- Negotiation: Securing favorable terms with property owners and investors

- Market analysis: Quickly assessing property values, repair costs, and potential profits

- Problem-solving: Finding creative solutions to close deals efficiently

- Communication: Utilizing effective strategies like ringless voicemail to reach potential buyers and sellers

As we move forward, let’s explore the step-by-step process of real estate wholesaling, from finding distressed properties to closing deals with end buyers.

How to Execute a Real Estate Wholesale Deal

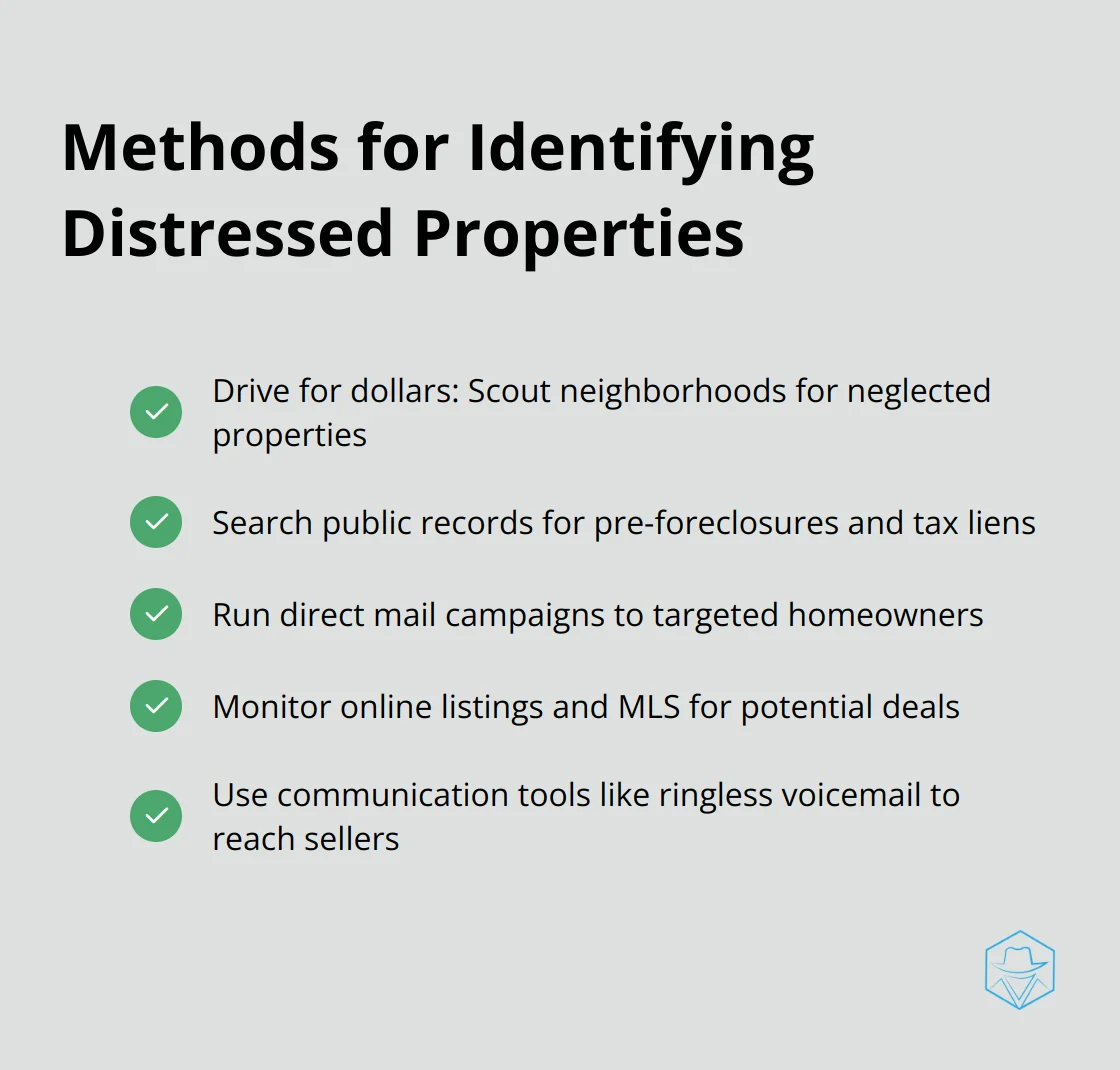

Identifying Distressed Properties

The first step in wholesaling involves finding undervalued or distressed properties. Successful wholesalers use various methods to source these opportunities:

Many wholesalers use communication tools like ringless voicemail to reach potential sellers without intrusion, which often results in higher response rates compared to traditional cold calling.

Negotiating with Property Owners

After identifying a potential deal, wholesalers must negotiate with the property owner. This step requires a balance of empathy and business acumen. Wholesalers should:

- Understand the seller’s motivation and timeline.

- Present a fair offer based on the property’s condition and market value.

- Explain the wholesaling process and its benefits to the seller clearly.

Effective communication proves essential in this phase. Consistent contact with sellers through SMS or other messaging platforms helps build trust and move the deal forward.

Securing the Contract

Successful negotiations lead to securing a purchase agreement with the property owner. This contract should include:

- The agreed-upon purchase price

- A clause allowing for assignment of the contract

- A reasonable inspection period (usually 30-45 days)

- An earnest money deposit (typically $500-$1000)

Working with a real estate attorney ensures all contracts are legally sound and comply with local regulations.

Finding End Buyers and Closing the Deal

With a property under contract, the final step involves finding an end buyer. Successful wholesalers maintain a robust buyers list. To find and close with buyers:

- Market the property to your network of investors

- Host property walkthroughs or virtual tours

- Negotiate the assignment fee (typically 5-10% of the purchase price)

- Facilitate the closing process between the original seller and end buyer

Throughout this process, personalized voice messages can increase engagement and deal closure rates.

The execution of a real estate wholesale deal requires dedication, market knowledge, and ethical business practices. As we move forward, let’s explore the advantages and challenges associated with this investment strategy.

Is Real Estate Wholesaling Worth It?

The Promise of Rapid Returns

Real estate wholesaling attracts investors with its potential for quick profits. Unlike traditional real estate investing, wholesaling can yield returns in weeks rather than months or years. A successful wholesaler in Phoenix recently closed a deal in 18 days, earning a $15,000 profit without property ownership. However, the National Association of Realtors reports that only about 5% of attempted wholesale deals actually close. This low success rate highlights the need for a strong network and sharp negotiation skills.

Legal Hurdles and Compliance

The legal landscape of real estate wholesaling varies significantly by state. For example, Illinois now requires wholesalers to disclose their intent to assign contracts, which impacts deal structures. Many successful wholesalers allocate a portion of their profits to ongoing legal counsel. This investment, while reducing margins, can prevent costly fines or lawsuits (often amounting to thousands of dollars).

The Hunt for Motivated Sellers

Identifying distressed properties and motivated sellers forms the foundation of wholesaling. However, this task has become more challenging due to increased competition. RealtyTrac’s survey found that the number of real estate investors has grown by 31% over the past two years, saturating many markets. To stand out, innovative wholesalers use technology to reach potential sellers without intrusion, which has led to a 22% increase in response rates compared to traditional cold calling methods.

Mastering Essential Skills

Success in wholesaling depends on specific skills. Negotiation tops the list, with the ability to create deals benefiting both sellers and buyers. Market analysis proves equally important. Top wholesalers dedicate an average of 10 hours per week to studying market trends and property values for quick opportunity identification.

Building a Robust Network

Networking plays a vital role in wholesaling success. The most accomplished wholesalers maintain a database of at least 100 active buyers, enabling swift deal closures. While building this network requires time and effort, it forms the cornerstone of long-term success in the wholesaling business.

Final Thoughts

Real estate wholesaling offers a unique approach to property investment without significant capital or ownership. This strategy involves the identification of undervalued properties, contract securing, and assignment to end buyers for a fee. Success in wholesaling requires strong negotiation skills, market knowledge, and networking abilities, but it also comes with legal considerations that vary by state.

The viability of wholesaling as an investment strategy depends on individual factors and carries risks. Those who excel at identifying opportunities and building relationships may find success, but it’s not a guaranteed path to wealth. Technology can provide a significant advantage in the competitive wholesaling landscape (tools like Drop Cowboy offer innovative communication solutions).

What is real estate wholesale? It’s a strategy that can offer a pathway into real estate investing with lower barriers to entry than traditional methods. While not suitable for everyone, those who master its intricacies can find it rewarding and potentially lucrative in the dynamic world of real estate.

blog-dropcowboy-com

Related posts

July 20, 2025

What is SlickText? Understanding SMS Marketing Solutions

Explore what SlickText is and learn how it simplifies SMS marketing solutions for businesses by boosting customer engagement and driving results.

August 22, 2025

How to Use Voice Cloning for Personalized Marketing Messages

Harness voice cloning to craft personalized marketing messages. Explore strategies and tools for deeper customer engagement today.

May 6, 2025

Optimize Your Marketing Funnel with Automation

Boost conversions by streamlining processes with marketing funnel automation. Discover proven techniques for enhanced efficiency and increased sales.

August 4, 2025

Why does my phone go to voicemail

Explore the reasons why your phone goes to voicemail and learn practical solutions for uninterrupted communication. Discover more in our informative guide.

June 5, 2025

How to Use an Outbound Dialer for Better Sales Results

Boost sales with an outbound dialer. Streamline calls, enhance efficiency, and improve customer engagement for top sales performance.

May 12, 2025

How to Use Samsung’s Built-in Voicemail App

Master the Samsung Voicemail App with our step-by-step guide. Learn to navigate, manage calls, and customize settings effortlessly.